You are here: Home > Our Services > Tax Accounting Services > Taxation

Taxation

Our suite of tax and audit services are perfect for businesses and individuals looking to ensure that they're well on top of the taxation guidelines set out by the Australian government.

They say that paying tax is one of the only things that's guaranteed in life. At WMC Accounting, we recognise that as a matter of fact for both individuals and businesses, but that doesn't mean that the whole process has to be laborious.

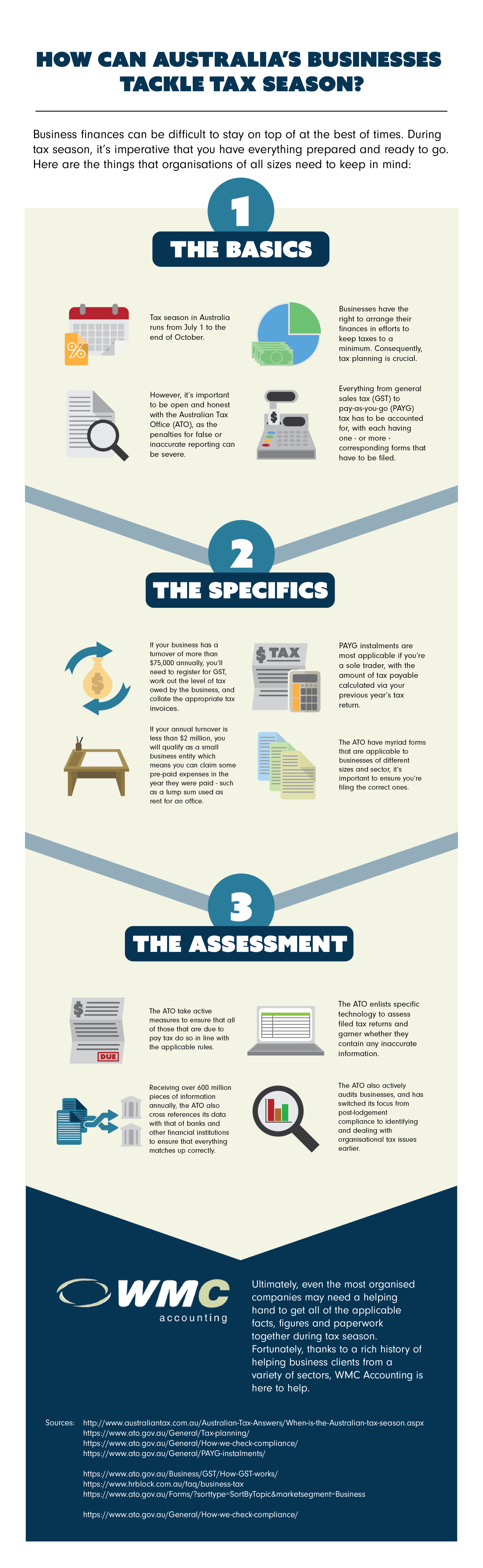

Naturally, there are myriad complexities to the Australian taxation system, but we lend a helping hand to all of our customers who may need just a nudge in the right direction to ensure that their finances are in order, and that they don't fall foul of the authorities.

The landscape for tax in Australia

The Australian government raises around two-thirds of its taxation revenue directly. Essentially, this encompasses the amount that's deducted from your pay packet each month. Consequently, it's easy to assume that the majority of taxation is taken care of for you. However, this mentality can lead to issues.

While the government does indeed have its taxation initiatives set up in a way that makes the system unavoidable, taxation is something that should be tackled proactively.

The business difference

At WMC, our suite of offerings centred on taxation can be leveraged by both individuals and businesses, but it's our work with the latter that sets us apart.

In particular, if you're the owner of a small to medium-sized enterprise, we'd love to hear from you as we're certain that our mix of knowledge and expertise can help you keep the taxman from your door, all the while defining the links between your business structure and taxation.

Going above and beyond

Our exceptional taxation consulting arm uses state of the art software to garner a holistic view of our client's finances. We aim to highlight any pain points and come up with innovative ways to ensure temporary problems don't turn into long-term issues.

We provide a complete service of help and advice in all of the following areas:

- Preparation of activity statements and advice on payment of tax

- GST/FBT obligations

- Advice on and implementation of tax effective trust structures for asset protection and tax minimisation

- Management of any ATO Audits or disputes

When engaging with us on preparing activity statements, working out FBT and GST obligations or perhaps working through ATO audits, clients will garner in-depth knowledge from our staff. That knowledge comes from decades of industry involvement. After all, our Directors John Cleary, Heath McCartney, Tom Aldridge & Darren Slattery each have 15-20 years' experience.

Contact us to see how we can improve your business.

Please take a few moments to read about the services we can provide. Whether it be Individuals, Partnerships, Trusts, Companies or Superannuation Funds, WMC Accounting has a service that is right for you.